MWCNTs Market Overview in China’s Lithium Battery Industry

“From 2022 to 2025, the MWCNTs penetrate rate in China’s lithium battery industry will increase by 10%~20%”

- 文章简介.

As a new nanomaterial, carbon nanotubes (CNTs) have gradually replaced the application value of traditional materials in electronics, energy, communications, the chemical industry, biology, medicine, aerospace, and other fields. They have excellent market potential.

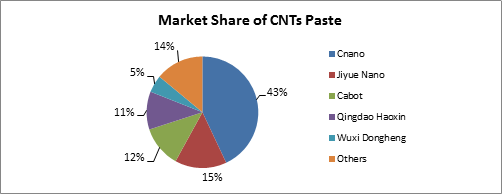

CNTs can be classified into single-walled nanotubes (SWCNTs) and multi-walled nanotubes (MWCNTs) according to the number of layers of graphene sheets. MWCNTs are the primary type of CNTs used in the market. From the present supply side, China CNTs manufacturers are mainly: Cnano Technology, Jiyue Nano, Cabot, Qingdao Haoxin and Wuxi Dongheng, etc. Among them, Cnano Technology accounts for 43% of the market share of CNTs paste, and Jiyue Nano follows them with 15% of the market share.

From the demand side, especially in China’s lithium battery market, the use of MWCNTs can improve the cycle performance of the battery and the conductivity of the electrode and reduce the polarization of the battery. At present, MWCNTs Currently, MWCNTs are added to the cathode of lithium batteries as a conductive agent in the form of a paste, which is gradually replacing the traditional conductive agent material and becoming a new conductive agent material. MWCNTs have the following advantages over conventional agents:

- The use of MWCNT in the cathode will improve the current conventional conductive network, forming dot, linear, and surface conductive networks, so the conductive effect is better than that of traditional conductive agents.

- The energy density will increase compared with the traditional conductive agent.

- The impedance is lower than the traditional conductive agents.

- Higher rate charge performance.

- Higher low-temperature charging and discharging performance.

From the perspective of demand structure, due to the lower conductivity of lithium iron phosphate compared with ternary materials, lithium iron phosphate has a more urgent demand for a conductive agent than ternary materials when achieving the same conductivity. Thus, the added amount of MWCNTs conductive agent varies by different battery materials. For example, MWCNTs paste usage volume for lithium iron phosphate batteries used in electric vehicles is about 750 tons/GWh. In comparison, the lithium cobalt battery operated in electric cars by 233 tons/GWh.

Regarding the applications, lithium-ion batteries are used in electric vehicles, consumer 3C products, electric tools, energy storage, and other fields. As other applications may have different requirements for a battery’s energy density and life cycle, the penetration rate would also differ. For example, the penetration rate of MWCNTs in lithium iron phosphate batteries for electric vehicles is as high as 75%. In comparison, lithium iron phosphate batteries for energy applications are only 5%.

After interviewing senior experts in the industry, GOLY Consulting estimated that the market size of MWCNTs paste (rather than MWCNTs powder) used in China’s lithium battery industry is estimated to be 166,000 tons in 2022. With a price of 30,000 ~40,000 RMB/ton according to the content of MWCNTs powder, the market value of MWCNTs paste used in China’s lithium battery industry is estimated to be 5 billion RMB to 6.6 billion RMB in 2022.

As for future needs, it is predicted that, by 2025, the MWCNTs penetrate rate in China’s lithium battery industry will increase:

- Power battery for electric vehicles: from 75% in 2022 to 80% in 2025

- Consumer batteries: from 30% in 2022 to 40% in 2025

- Energy storage battery: from 5% in 2022 to 20% in 2025

- Batteries used in power tools: from 20% in 2022 to 40% in 2025

- Batteries used in a two-wheel vehicle: from 5% in 2022 to 20% in 2025

GOLY believes that with the continuous development of new energy vehicle endurance and fast charging technology, the demand for conductive materials is more urgent. With the promotion of the pursuit of the high energy density of batteries, the performance advantages of MWCNTs conductive agents are increasingly highlighted, and the market potential OF MWCNTs is expected to proliferate.